How to Live on $36,000 a Year

“This is a parable about how any amount of money can disappear if we do not take the reins of control in our hands. ”

As we enter a new year, I’ve been reviewing our finances and preparing a year-end analysis – just another one of those super time-consuming, nerdy things I secretly adore.* In addition to my usual financial year-end tasks, I’ve also been preparing for the new Roaring 20s by rereading a favorite of mine, Z: A Novel of Zelda Fitzgerald(I would recommend reading this in conjunction with The Paris Wife. It’s an excellent companion).

Of course, I fell down a rabbit hole rereading Fitzgerald’s works. Money is an overarching theme in so much of it. As a history and literature buff, I want to learn from the financial climates of the ‘20s and see if they are still applicable a century later.

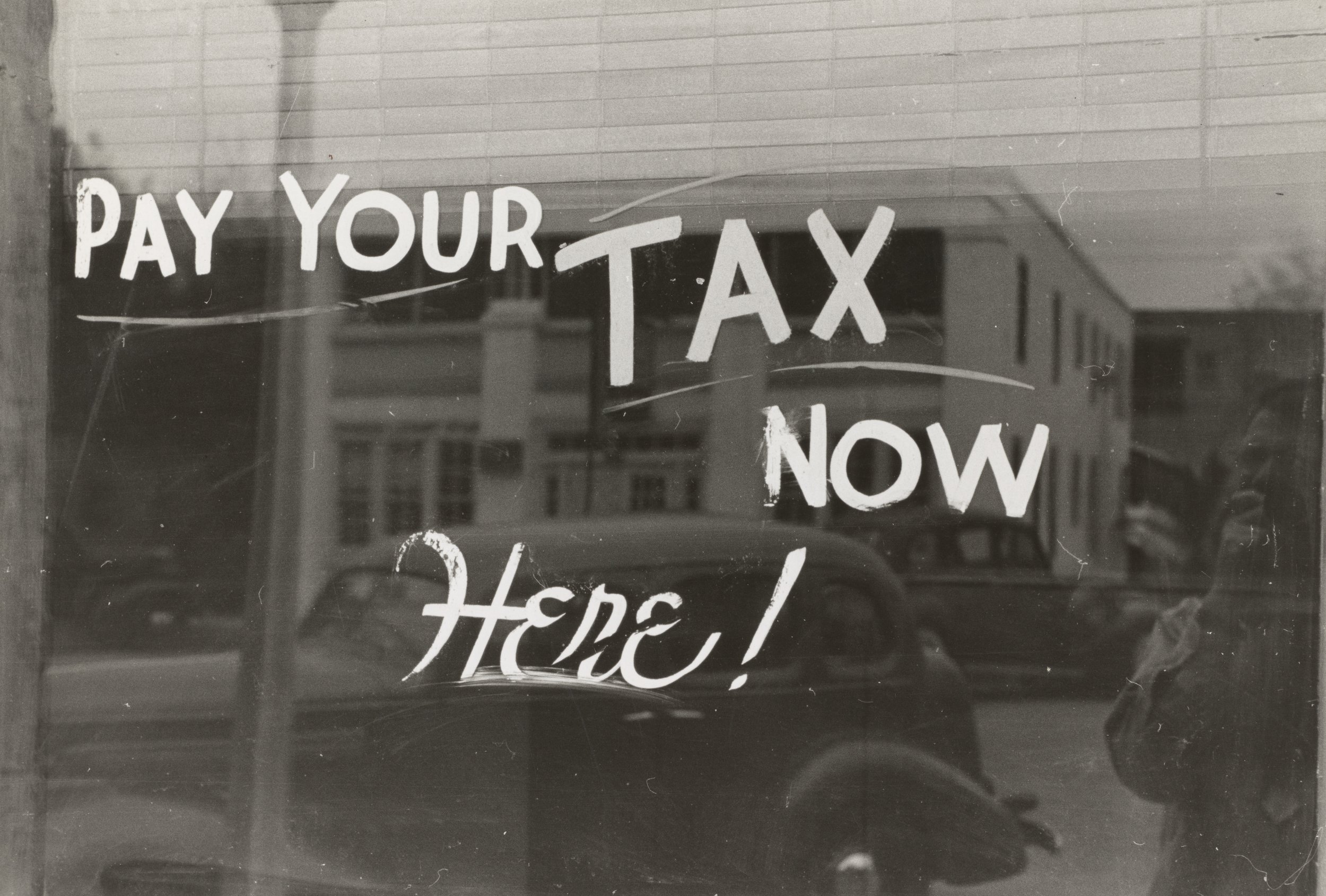

In 1924, the Great Gatsby author penned a piece for the Post called “How to Live on $36,000 a Year, poking fun at their own credit-reliant lifestyle. Short and entertaining, here’s 103 year-old proof that the more things change, the more they stay the same.

In 1923, F. Scott and Zelda Fitzgerald were living at the Plaza Hotel. They just found out they were broke. So broke, in fact, that they were not able to pay their bill. Not a problem; the famous writer knew that there would be more money; his stories would pay for it all. Those stories just needed to be written. To cover the gaps in the meantime, he moved his wife and child to a Tarrytown rent house and began writing anew. A year passed, and once again, he found himself penniless. At Zelda’s suggestion, he created a self-portrait of their year among the nouveau riche of New York. The article was published in April in the Post under the title “How to Live on $36,000 a Year.”

At the time, $36,000 was an exorbitant amount of money, somewhere between $530,000 and $1.2 million.** Scott made a tally of their past years’ income and expenses, performing the literary equivalent of turning out one’s pockets to let the public count the pennies and lint within. Today, it’s a time capsule of financial comparisons:

$36,000 means something quite different than when F. Scott wrote his tale, but the problems are all too familiar to a modern audience. Child care is expensive; as is food and trips and vices of all sizes and shapes. We have the idea that more money will make us happier, and to a certain extent, it does. But often these Gatsby-sized lifestyles are hiding an insidious amount of debt and expense, and probably the bodies of a few of the Joneses.

Having too little to buy too much is not a new problem; these ghosts have been haunting us for years. We already have the solution for financial control: make more, spend less, and track expenses. Quite simple – but not at all easy.

Fitzgerald’s article underlines a bigger takeaway than a discussion about class, the grievances of being priced out of a neighborhood, or the acknowledgement that children can be a luxury: this is a parable about how any amount of money can disappear if we do not take the reins of control in our hands.

So, in the spirit of F. Scott and Zelda Fitgerald: in this new decade, may your finances allow you both frivolity and fortune, and may you have the wisdom to keep both.

*At the end of the year, we have a comprehensive report that includes our assets, expenditures, overall net worth, business and personal financial statements, notes and criticisms, percentage of goals met, and pie charts! I can provide a more detailed post on how I do this (and my updated system for 2020 that uses YNAB and my Good Notes app). For 2020, I am excited that we are becoming a one-card household – no more tracking multiple expense streams!

**Due to finicky things like inflation and purchasing power, there is no way to nail down a finite value of this amount. The real wage value of income would be $530,000, but the household expenditures value would be $1.21 million. In any case, this is an incredible amount of wealth, either from the payer’s perspective, or the payee’s.