Tax Season Pt. 2

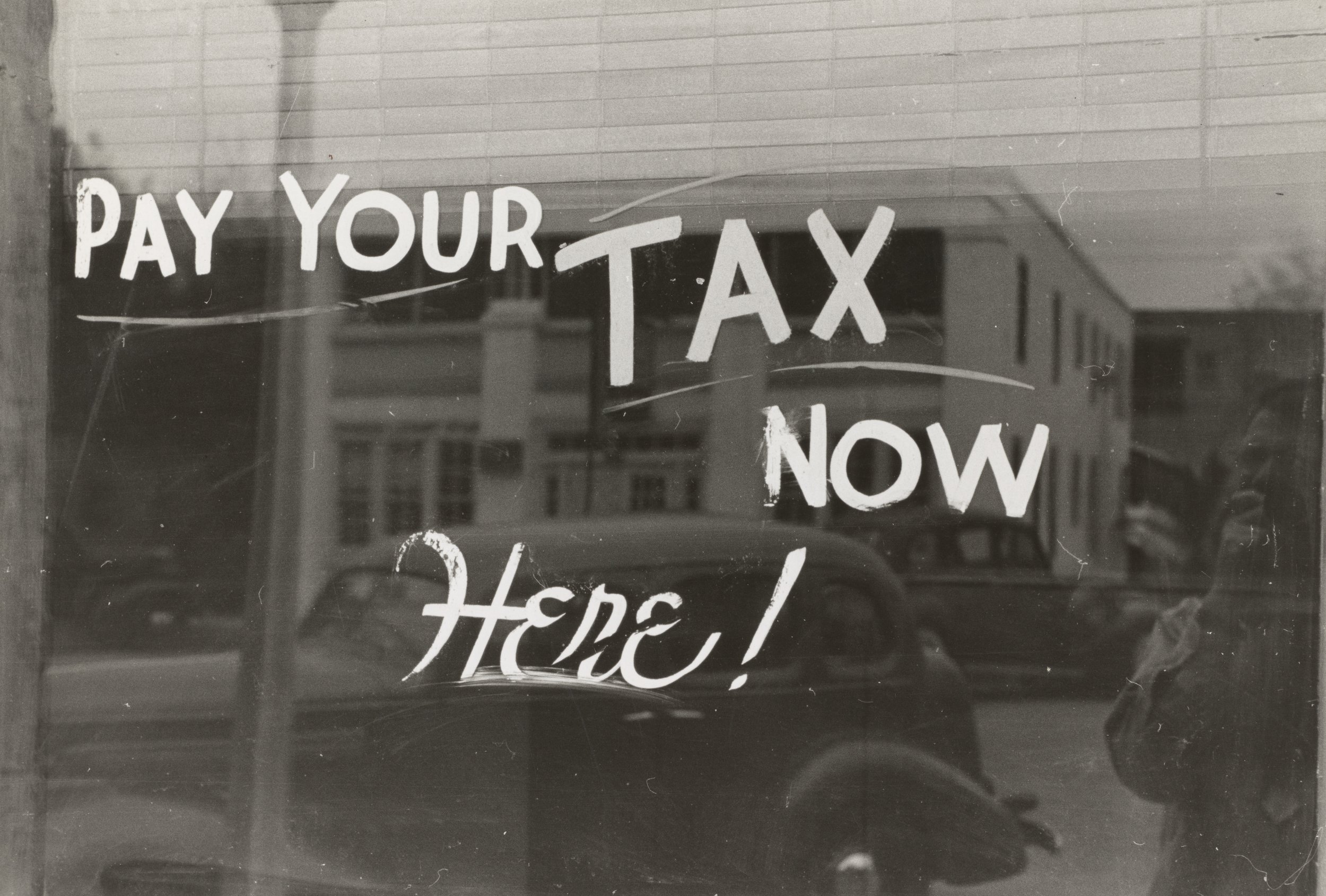

Happy Tax Season Pt. 2!

For those of you who haven’t been scrambling around frantically since September 1st, there are two major tax deadlines during the early days of fall: the corporate deadline on September 15th, and the individual deadline on October 15th.

For most businesses filing as corporations or partnerships, the April deadline is not even on their radar. It takes 6-10 months to complete books from the previous year and to wrap up any needed transactions before completing K-1’s and such. If the company you own a percentage of hasn’t filed their taxes, you haven’t received your paperwork to complete your personal taxes!

It’s a little bit of a joke that the two types of people filing their taxes in September and October are either rich or don’t have their $hit together. (In my experience, it’s both). For those of us in the FIRE community, you should prepare to begin filing your taxes by October 15th – while the majority of companies will provide an end-of-year statement (commonly called a 1099-DIV and/or 1099-B) prior to April 15th, most investors will still be receiving necessary tax documents until the middle of summer.

As someone in public accounting, these two deadlines have us half-insane and entirely caffeinated. Which is, unfortunately, why the blog has to take a backseat. Any content produced during this time is absolutely prepped beforehand, and I am sorry I didn’t get a chance to do that this summer. In previous years, this was such a hidden little Excel project I’d work on for fun, and it’s still an adjustment to adhere to a posting schedule. (Forgive me! And send more K-cups and Bang.)

Be expecting some fun new fictional finances in the next few weeks as we enter into the witchiest season of the year! I have some Halloween fun I’ve been excited about all year on the way that will then segue into the holidays and Tax Season 2020.